For Immediate Release

Company name: DAIICHI SANKYO COMPANY, LIMITED

Representative: Joji Nakayama, Representative Director, President and CEO

(Code no.: 4568, First Section, Tokyo Stock Exchange)

Please address inquiries to Noriaki Ishida, Executive Officer,

Vice President, Corporate Communications Department

Telephone: +81-3-6225-1126

http://www.daiichisankyo.com

Daiichi Sankyo to Issue Share Options as Remuneration

TOKYO, Japan (June 22, 2015) – Daiichi Sankyo Company, Limited (hereafter “Daiichi Sankyo”) has announced that its Board of Directors today reached a decision to issue share options to remunerate Directors (excluding Outside Directors) and Corporate Officers pursuant to Articles 236-1, 238-1, 238-2, and 240-1 of the Companies Act of Japan. The particulars are as set forth below.

I. Reason to issue share options

At Daiichi Sankyo, the remuneration system for Directors (excluding Outside Directors) and Corporate Officers is designed to provide remuneration that contributes to maximize corporate value. Rather than employing retirement benefit schemes, the Company shall grant share remuneration-type stock options, which use share options based on an exercise price of one (1) yen per share.

II. Details of the share options

1. Name of share options

Daiichi Sankyo Company, Limited No. 9 share options

2. Persons to whom share options are offered

Six Directors (excluding Outside Directors) and 16 Corporate Officers of the Company.

3. Total number of share options

1,187 share options

The number of shares that are the subject matter per one share option shall be 100 shares of the Company. However, if the number of granted shares stipulated in 4. (1) below is adjusted, the total number of shares subject to share options shall be adjusted accordingly. The above number is the expected number of the allotment. If the total number of the share options to be allotted is less than expected, such as in the case where applications are not made as expected, total number of allotted share options will be reduced accordingly.

4. Content of share options

(1) Type and the number of shares which are the subject matter of share options

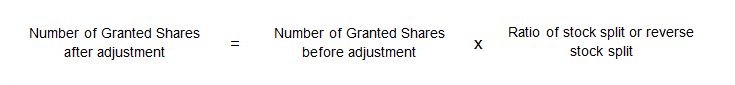

Type of shares which are the subject matter of share options shall be ordinary shares, and the number of shares which are the subject matter of respective share options (hereafter “Number of Granted Shares”) shall be 100. If the Company effects a stock split or a reverse stock split of its shares after the allotment date, the Number of Granted Shares shall be adjusted using the following formula. However, such adjustment shall be made with respect to the Number of Granted Shares not exercised at that time.

In addition, if the Company merges with another company or splits, effects a free allotment, or otherwise adjusts the Number of Granted Shares, the Company may properly adjust the number of shares to the reasonable extent.

(2) Amount of assets paid upon exercise of share options

The assets paid upon exercise of the share options shall be the amount calculated by multiplying the per-share amount (hereafter “Exercise Price”), which stands at one (1) yen, by the Number of Granted Shares.

(3) Period in which share options can be exercised

From July 8, 2015 to July 7, 2045

(4) Matters concerning increase in capital and capital reserve when shares are issued through the exercise of share options

i The increase in capital when shares are issued through the exercise of share options shall be half of the limit amount of an increase in capital, etc. to be calculated in accordance with Article 17-1 of the Ordinance on Company Accounting, and any fractions less than one (1) yen which may occur as a result of calculation shall be rounded up.

ii The increase in capital reserve when shares are issued through the exercise of share options shall be the limit amount of an increase in capital, etc. stated in (i) above less increase in capital as provided in (i) above.

(5) Restriction on acquisition of the share options by assignment

Acquisition of share options by assignment shall be subject to the approval of the Board of Directors.

(6) Events and conditions for acquisition of share options

i When persons to whom share options are granted (hereafter “Holders of share options”) can no longer exercise their rights pursuant to the provisions specified in (9) below, the Company may acquire, fee of charge, the said share options held by the said Holders of share options on the day separately determined by the Board of Directors.

ii When an absorption-type merger agreement, under which the Company is absorbed and disappears, is approved at a general meeting of shareholders of the Company (a meeting of the Board of Directors if a resolution of a general meeting of shareholders is not required), or when a proposal on approval of a share exchange agreement, under which the Company will become a wholly-owned subsidiary company in the share exchange, or a proposal on approval for a share transfer plan, under which the Company will become a wholly-owned subsidiary company in the share transfer, is approved at a general meeting of shareholders of the Company (a meeting of the Board of Directors if a resolution of a general meeting of shareholders is not required), the Company may acquire, free of charge, the share options held by the holders of share options on the day separately determined by the Board of Directors.

iii When Holders of share options offer in writing to abandon all or part of their share options, the Company may acquire, free of charge, the said share options held by those holders of share options on a day separately determined by the Board of Directors.

(7) Delivery of share options in the case of merger, acquisition and split, new establishment and split, share exchange or share transfer

When the Company conducts a merger (only when the Company no longer exists due to the merger), acquisition and split, new establishment and split, share exchange, or share transfer (hereafter “Reorganization Acts”), it shall deliver share options of joint stock companies indicated in Article 236-1-8-(a) to (e) of the Companies Act of Japan (hereafter “Companies Subject to Reorganization”) to those qualified for receiving share options which are outstanding on the day the Reorganization Acts become effective (hereinafter “Outstanding Share options”) in respective cases under the conditions shown below. In this case, the Outstanding Share options become extinct, and the Companies Subject to Reorganization shall issue new share options. However, the purposes of delivery of share options of the Companies Subject to Reorganization shall be limited to those designated in the acquisition and merger contract, new establishment and merger contract, acquisition and split contract, new establishment and split plan and share exchange contract, or share transfer contract in line with the following conditions:

i Number of share options of the Companies Subject to Reorganization to be delivered

The same number of Outstanding Share options as that of those held by Holders of share options shall be delivered.

ii Type of shares which are the subject matter of share options Ordinary shares of the Companies Subject to Reorganization

iii Number of shares which are the subject matter of share options

Number of shares shall be determined in the same manner stipulated in (1) above, taking conditions for the Reorganization Acts into consideration.

iv Amount of assets paid upon exercise of share options

Amount of assets paid upon exercise of respective share options delivered shall be the amount calculated by multiplying the exercise price after adjustment, which is obtained by adjusting the Exercise Price by the number of shares of the Companies Subject to Reorganization stipulated in (iii), which are the subject matter of such share options, taking conditions for the Reorganization Acts into consideration.

v Period in which share options can be exercised

The period in which the delivered share options can be exercised is the first day of the period provided in (3) above or the day the Reorganization Acts become effective, whichever comes later, to the last day of the period provided in (3) above.

vi Matters concerning increase in capital and capital reserve when shares are issued through the exercise of share options

To be determined in the same manner as in (4) above.

vii Restriction on acquisition of share options by assignment

Acquisition of share options by assignment shall be subject to the approval of the Board of Directors of the Companies Subject to Reorganization.

viii Conditions for exercise of share options and events and conditions for acquisition of share options

To be determined in the manner provided in (6) above and (9) below. Reorganization Acts are to be set by Board of Members of the Company.

(8) Treatment of fractions

If there are fractions of less than one share in shares to be delivered to the Holders of share options, such fractions shall be rounded down.

(9) Conditions for the exercise of share options

i Holders of share options may exercise their share options until the last day of the last fiscal year that ends within 10 years from the following day of the day when they retired from their office as Director or Corporate Officer of the Company that they held when the share options were granted (if the persons granted share options concurrently serve as Director and Corporate Officer, the day when they retired from office means the day when they retired from the office of Director, regardless of whether they continued to hold the position of Corporate Officer; and if the holders of share options served as Corporate Officer when the share options were granted and if they took office as Director upon their retirement from office as Corporate Officer, the day when they retired from office means the day when they retired from office as Director, not the day when they retired from office as Corporate Officer).

ii Holders of share options may not dispose of the share options by any means, including pledging..

iii When holders of share options die, their heir may inherit the share options that have not been exercised as of the day when the cause of their inheritance occurs, and may exercise the rights in accordance with the terms of the Agreement on Allotment of Share Options, to be entered between the Company and holders of share options.

iv When holders of share options exercise their share options, they may not partially exercise one stock acquisition right.

v Other conditions are set force in the Agreement on Allotment of Share Options, to be entered between the Company and holders of share options, in accordance with the resolution of the Board of Directors.

(10) Other details regarding share options shall be stipulated in an “agreement on offering of share options” to be entered into between the Company and the Holders of share options.

5. Subscription amount for share options

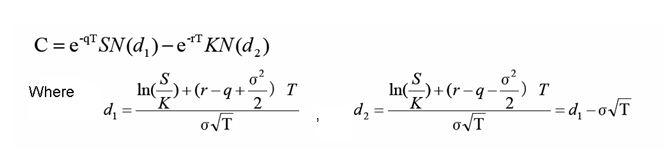

At the Offering Date of the share options, the subscription amount is calculated using the Black-Scholes model. The Company and the Holders of share options shall offset subscriptions in cash against such claims for compensation on the due date of subscription.

The Black-Scholes model is shown below.

i Option price per stock (C)

ii Unit price (S): Closing price of the Company’s ordinary share in regular transactions for July 7, 2015 (day of granting) from the Tokyo Stock Exchange (if there is no closing price, the unit price for the following day is used)

iii Exercise price (K): One (1) yen

iv Projected period to maturity (T): Ten (10) years

v Share price volatility (σ): Based on closing stock price of trading of ordinary shares of the Company from September 28, 2005 to July 7, 2015

vi Risk-free rate of interest (r): Interest rate of government bonds for the remaining years of the projected period to maturity

vii Projected dividend (q): Dividend per share (The dividend paid for the past twelve (12) months (total of the dividend paid in September 2014 and March 2015 )) divided by the Unit price as in (ii) above)

viii Standard normal cumulative distribution function (N (・))

6. Offering Date

July 7, 2015